$500

$10,000

As soon as next business day

BadCreditLoans.com has built a reputation for connecting borrowers with less-than-perfect credit to potential lenders. But is it all it's cracked up to be? Let's dive in.

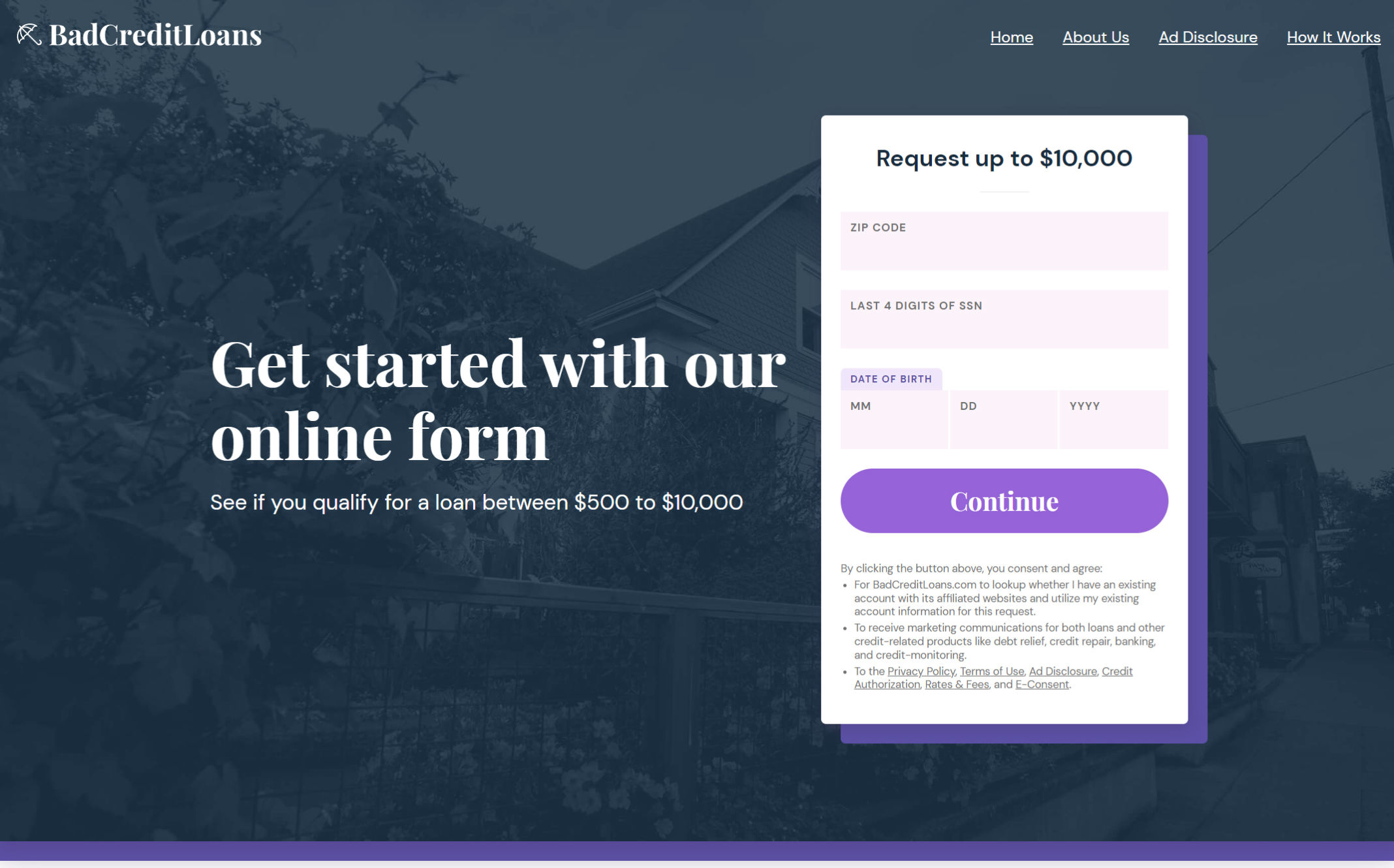

BadCreditLoans.com has been in the lending space since 1998, specializing in helping those with bad credit connect with lenders that may be willing to assist. Their services are available 24/7/365, making them a convenient option for borrowers at any time.

Borrowers can apply for loans ranging from $500 to $10,000, with loan terms between 3 to 36 months. The interest rates, however, vary and can range from 5.99% to 35.99%.

Applying does NOT affect your credit score!

Key Takeaways

About BadCreditLoans.com: Founded in 1998, BadCreditLoans.com connects individuals with poor credit to potential lenders. The service operates 24/7/365 and can facilitate loans ranging from $500 to $10,000, with interest rates varying from 5.99% to 35.99%.

Application and Eligibility: The application process is quick and requires no fee. To be eligible for a loan, applicants need to be at least 18, have proof of citizenship or legal residency, a regular income, a checking account, and valid phone numbers and email address.

Pros and Cons: While BadCreditLoans.com offers the convenience of a quick application process and the ability to compare multiple loan options, it lacks transparency about potential rates, has received an F rating from the Better Business Bureau, and there are concerns about personal data being sold.

Conclusion and Advice: Despite some drawbacks, BadCreditLoans.com can be a valuable resource for individuals with poor credit. Prospective borrowers should weigh the pros and cons, understand the terms and conditions, and consider other lenders before making a decision.

To be eligible, borrowers must be at least 18 years old, provide proof of citizenship or legal residency, have a regular income, have a checking account in their name, and provide work and home telephone numbers and a valid email address.

The application process for BadCreditLoans.com is quick, and there's no fee to apply. If approved, borrowers may receive their money as soon as the next business day.

BadCreditLoans offers the convenience of a quick application process and the ability to compare multiple loan options. This makes it a useful tool for those unsure of where to turn for a loan they might qualify for.

While BadCreditLoans.com provides several benefits, there are some potential drawbacks to be aware of. The platform is not upfront about potential rates, and most short-term loans come with APRs in the triple digits. This lack of transparency may make it difficult for borrowers to fully understand the financial commitment they are entering into.

In addition, while the platform connects borrowers with potential lenders, it does not guarantee that these lenders will offer the most favorable rates or terms. Borrowers should always compare offers from multiple sources before making a decision.

Lastly, while the platform does take steps to protect user data, there is a risk that your personal information may be sold as a "lead". This could potentially lead to unwanted marketing communications or other privacy concerns.

Applying does NOT affect your credit score!

BadCreditLoans has received mixed reviews from customers. Some users appreciate the platform for its quick and easy application process, as well as its ability to connect them with potential lenders. However, the platform has also received criticism for its lack of transparency regarding interest rates and the potential for personal information to be shared with third parties. It also has an F rating from the Better Business Bureau.

Applying does NOT affect your credit score!

When compared to other lenders in the market, Bad Credit Loans stands out for its specific focus on individuals with bad credit. The platform's network of lenders is designed to consider applications from borrowers who may not be approved by traditional lenders due to their credit scores. This makes it a potentially valuable resource for those who have struggled to secure loans elsewhere.

However, borrowers should be aware that this focus on bad credit borrowers can come with higher interest rates. As always, it's crucial to thoroughly review all loan terms and conditions before agreeing to a loan.

BadCreditLoans.com offers a potentially valuable service to those with bad credit, connecting them with a network of lenders that may be able to provide a loan. The quick application process and broad network of lenders are definite advantages. However, potential borrowers should be aware of the drawbacks, including potentially high-interest rates and the sharing of personal information.

Before making any decisions, it's important to consider all your options and understand the terms of any loan you are considering. And remember, while BadCreditLoans.com can help you find potential loans, the final decision on whether to take out a loan - and which loan to take out - is always yours.

1. What is BadCreditLoans.com?

BadCreditLoans.com is an online service that connects borrowers with potential lenders. They specialize in helping those with bad credit find potential loan options.

2. What are the loan amounts and terms available through BadCreditLoans.com?

Loans range from $500 to $10,000, with loan terms between 3 to 36 months.

3. What are the eligibility requirements for a loan through BadCreditLoans.com?

Applicants must be at least 18 years old, provide proof of citizenship or legal residency, have a regular income, have a checking account in their name, and provide work and home telephone numbers and a valid email address.

4. What is the application process like for BadCreditLoans.com?

The application process is quick and easy. Applicants fill out one online form, and if approved, may receive their money as soon as the next business day.

5. Does BadCreditLoans.com charge any fees?

There is no fee to apply for a loan through BadCreditLoans.com. However, potential borrowers should be aware that lenders may charge fees