$250

$35,000

2 to 96 Months

There comes a time in every person's life when they need a bit of financial help. Whether it's an unexpected medical bill or a much-needed home renovation, personal loans can be a lifesaver. One such platform that has emerged as a reliable source of personal loans is PersonalLoans.com. But what does this platform offer and is it the right choice for you? Let's find out.

PersonalLoans.com is not a lender. Instead, it's a lending platform that connects borrowers with potential lenders. They serve as your middleman, offering you a range of loan options from different lenders based on your financial profile.

Applying does NOT affect your credit score!

Key Takeaways

Platform Overview: PersonalLoans.com is an online platform that connects borrowers with potential lenders. It does not issue loans directly but rather serves as a middleman to help users find loans that suit their needs, including peer-to-peer loans, personal installment loans, and bank personal loans.

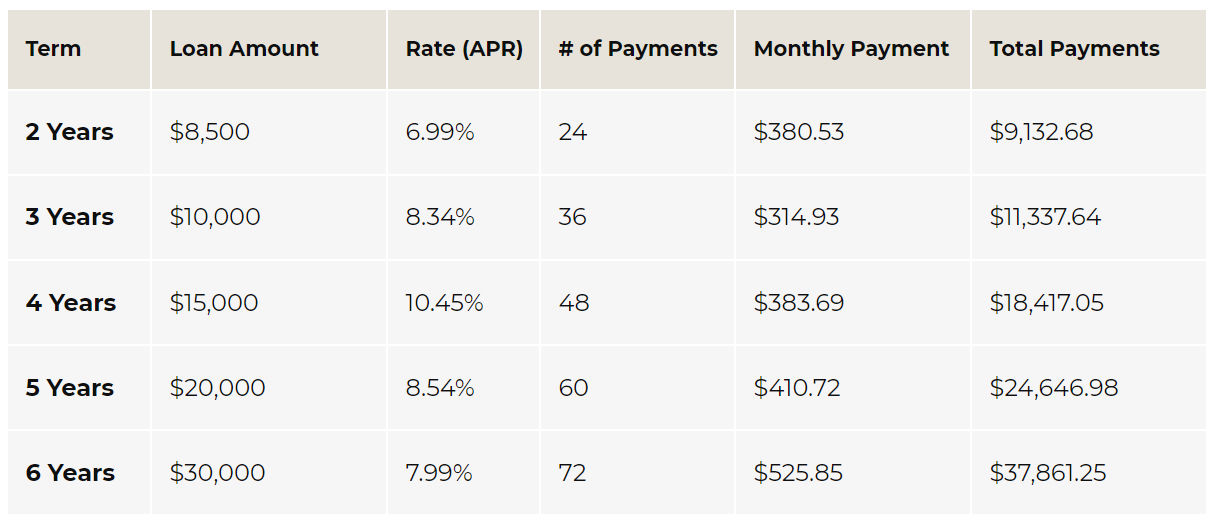

Loan Terms and Interest Rates: The platform offers loan amounts ranging from $250 to $35,000, with APRs ranging from 5.99% to 35.89%, though rates could potentially be higher when dealing with certain lenders. Loan terms can be as short as 61 days or as long as 96 months.

Fees and Approval Time: PersonalLoans.com provides its service completely free of charge. However, if you accept a loan offer from a lender, the lender will typically charge an origination fee or other fees.. If approved, borrowers can often receive their funds within 1 business day.

Credit Score Requirements: PersonalLoans.com does not have a specific minimum credit score requirement, making it a potential option for individuals with poor credit. However, the terms and rates you're offered will likely depend on your creditworthiness.

PersonalLoans.com offers a fixed APR personal loan product that ranges from 5.99% APR up to 35.89% APR, though the range could potentially be even higher depending on the lender you're matched with. The loan amounts available range from $250 to $35,000.

PersonalLoans.com offers loans with terms of up to 96 months, providing flexibility based on your financial situation and repayment ability.

PersonalLoans.com provides its service completely free of charge. However, the exact amount of origination fee can vary depending on the lender you are matched with. For example, peer-to-peer lenders who work with PersonalLoans.com generally charge a loan origination fee of 1 – 5%.

Applying does NOT affect your credit score!

PersonalLoans.com does not require or disclose a specific credit score minimum, but the minimum credit score for peer-to-peer loans is 600 and 580 for personal installment loans and bank personal loans. There is also no disclosed minimum annual income requirement, but they will consider your ability to repay the loan.

In order to qualify for a loan from PersonalLoans.com, you must be at least 18 years old or the state minimum, whichever is higher. U.S. citizens and permanent resident/green card holders are eligible to apply. Active duty service members and their dependents are also eligible, with rates falling within the limits of The Military Lending Act.

If you apply for a loan via PersonalLoans.com, you can expect to receive a credit approval decision in less than an hour. If approved, you can sometimes get your money within 1 business day.

These loans are financed by connecting investors directly with borrowers. You won't be borrowing from a bank at all — you'll get your money straight from another person or company.

These are the typical loans most people think of when they hear the words personal loan. These loans are fast, fairly straightforward, and require you to pay back money a little at a time to your lender, generally in the form of a monthly payment.

PersonalLoans also helps link borrowers with their local banks. However, if you already know which bank you'd like to get a loan from, you could skip this step and contact the bank directly yourself.

While PersonalLoans.com is committed to protecting its customers' personal information, their transparency could be better. As they act as the middleman, it can be hard to disclose any terms that will help a potential applicant make an informed choice. Therefore, it's crucial to carefully read any agreement you're considering.

Applying does NOT affect your credit score!

Every financial product has its strengths and weaknesses. Knowing these can help you make an informed decision.

The most significant advantage of PersonalLoans.com is its accessibility. The platform offers loans to borrowers with less-than-stellar credit. Plus, you can get a decision quickly, and if you qualify for the lower end of their APR range, you can get a competitive rate.

On the flip side, costs can quickly add up if you qualify for the higher end of the APR range. Plus, since PersonalLoans.com is a lending platform and not a direct lender, you must read the fine print carefully. It's also worth noting that a hard pull on your credit might be performed, which can affect your credit score temporarily.

In conclusion, PersonalLoans.com provides a valuable service for those with poor credit or limited options. The platform offers a variety of loan options with competitive rates for those who qualify. However, it's essential to read the fine print and understand all the terms before accepting a loan offer.

Does PersonalLoans.com lend money directly?

No, PersonalLoans.com does not lend money directly. It is a platform that connects borrowers with lenders. They serve as a middleman to link you up with an offer from a lender.

What is the range of loan amounts that can be borrowed through PersonalLoans.com?

You can borrow amounts ranging from $250 to $35,000 through PersonalLoans.com.

What is the interest rate range for loans from PersonalLoans.com?

The interest rates for loans through PersonalLoans.com range from 5.99% APR up to 35.89% APR, though the rate could potentially be even higher if you're matched with certain tribal lenders.

What types of loans does PersonalLoans.com offer?

PersonalLoans.com offers a variety of loan types, including peer-to-peer loans, personal installment loans, and bank personal loans.

What are the term lengths for loans through PersonalLoans.com?

Loan terms through PersonalLoans.com can range from as short as 61 days to as long as 96 months.

Does PersonalLoans.com charge an origination fee?

Yes, PersonalLoans.com may charge an origination fee. However, the exact amount can vary depending on the lender you are matched with.

How quickly can I receive funds if I'm approved for a loan through PersonalLoans.com?

If you're approved for a loan through PersonalLoans.com, you can sometimes get your money within 1 business day.

Can I apply for a loan through PersonalLoans.com if I have poor credit?

Yes, PersonalLoans.com does not require a specific minimum credit score and they work with lenders who may approve borrowers with poor credit. However, the terms and rates you're offered will likely depend on your creditworthiness.